Little Known Facts About What Is Trade Credit Insurance.

Wiki Article

What Is Trade Credit Insurance Things To Know Before You Get This

Table of ContentsSee This Report about What Is Trade Credit InsuranceThe 5-Second Trick For What Is Trade Credit InsuranceWhat Does What Is Trade Credit Insurance Do?

After that, during the year, if any of those purchasers fail or don't pay, after that we will make the settlement. We look at the whole turnover of a business and we finance the entirety. "What we're seeing via electronic platforms is that individuals can go online and can market a single invoice.

What the consumer can then do is take the option to guarantee that solitary invoice. "At Euler Hermes, we think there's going to be a shift in the means profession credit rating insurance is distributed.

The Best Strategy To Use For What Is Trade Credit Insurance

Need a broker? See our guide to finding the best broker.

For instance, a maker with a margin of 4% that experiences a non-payment of 50,000 would need 25 comparable sales to make up for a solitary instance of non-payment. Credit report insurance coverage mitigates against this loss. You can reduce costs on credit information as that's covered, as well as you will not require to lose resources on chasing after collections.

You might have the ability to negotiate good terms with your providers as a credit score insurance coverage lowers the impact of an uncollectable bill on them and also possibly the entire supply chain. Credit rating insurance coverage is there to aid you protect against as well as reduce your trading risks, so you can establish your service with the expertise that your accounts are secured.

A service wanted to broaden sales with its existing consumers but was not completely comfortable supplying them higher credit line. They spoke to Coface credit score insurance coverage to cover the greater credit report restrictions so they might increase the amount of credit history used to consumers without risk - What is trade credit insurance. This let them grow revenues and also supply more earnings.

The Ultimate Guide To What Is Trade Credit Insurance

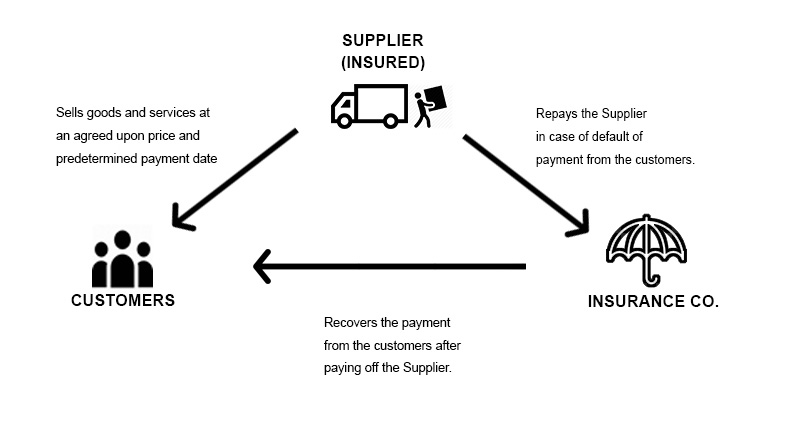

"From the initial objective of offering comfort to our banks, the solution added depth to site web our organization choices." The interaction allowed the company to assess its customers' condition more accurately and also has actually been an important device in organization linked here advancement.Australian businesses owe around $950 billion to various other businesses. Which indicates it's necessary to have securities in area to make sure that in the event a lender does not meet its commitments, the organization can still redeem its money. Getting trade credit score insurance is one means you can do this. Profession credit score insurance provides cover when a consumer either ends up being bankrupt or does not pay its debts after a certain period (which is laid out in the insurance coverage policy).

"In the event a financial obligation is unpaid, the plan owner might be able to claim up to 90 per cent of the quantity of that debt, taking into consideration any kind of unwanteds that might matter," he includes. When it involves collecting the debt, frequently the insurance company will certainly have its own financial debt collection agency and will seek read here the debt in behalf of business.

Report this wiki page